Memo #328

By Grégoire-François Legault – gregoire.legault [at] alumni.ubc.ca

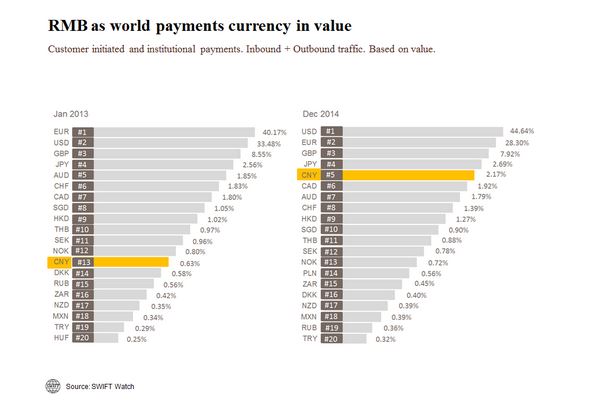

Though internationalization of the renminbi (RMB, the “redback”) is far from complete, it is well under way. In 2014, China signed eight new agreements to establish RMB hubs around the globe, and the redback was used to settle almost 25% of payments across China’s borders. The RMB is already the fifth most used currency for international payments – in December 2014, 2.17% of global payments were conducted using the redback, thereby displacing the Canadian and Australian dollar. By the end of 2015, the RMB is projected to overtake the Japanese yen as the fourth most used currency. Canada now needs to consolidate its position as a renminbi hub, as well as to consider launching free trade agreement negotiations with China.

Though internationalization of the renminbi (RMB, the “redback”) is far from complete, it is well under way. In 2014, China signed eight new agreements to establish RMB hubs around the globe, and the redback was used to settle almost 25% of payments across China’s borders. The RMB is already the fifth most used currency for international payments – in December 2014, 2.17% of global payments were conducted using the redback, thereby displacing the Canadian and Australian dollar. By the end of 2015, the RMB is projected to overtake the Japanese yen as the fourth most used currency. Canada now needs to consolidate its position as a renminbi hub, as well as to consider launching free trade agreement negotiations with China.

Last November, the Bank of Canada (BoC) and the People’s Bank of China (PBoC) signed a bilateral swap agreement (200 billion RMB/30 billion CAD), as well as a memorandum of understanding laying the foundations for the establishment of a renminbi hub in Canada. On November 9, the Industrial Commercial Bank of China (ICBC) was designated by PBoC as the clearing bank responsible to settle transactions, a move that will enable round-the-clock renminbi trading around the world. The Canadian hub, which could be operational in 6 months to 2 years, is expected to dramatically boost trade between the two countries and to benefit the Canadian financial sector. Indeed, current estimates indicate that the direct benefits of a hub would be anywhere between 21 to 32 billion dollars over the next 10 years in increased exports, in addition to potential discounts on imports of 2.8 billion dollars and 6.2 billion in reduced transaction costs.

Establishing a renminbi hub in Canada was the easy task, so what comes next? First, stakeholder groups will need to help Canadian and Chinese businesses tap into the benefits of a renminbi hub by promoting the use of the renminbi. Second, now armed with both a bilateral investment treaty (BIT) and a renminbi hub, the next logical step for Ottawa is to start negotiating a free-trade agreement (FTA) with Beijing as soon as possible. Some of Canada’s trade competitors in Asia, namely Australia and New Zealand, all have FTAs with China. The absence of an FTA reduces the benefits of a currency hub and puts Canadian exporters at a serious disadvantage. Even though Canada and China have agreed to establish a panel to examine ways of deepening bilateral cooperation in areas such as trade and economic relations, this non-committal approach falls short of a true strategic economic partnership sealed with a trade agreement. Unfortunately, with federal elections looming, the Canada-China bilateral relation will continue to lack a clear direction until the electoral dust settles.

About the Author:

Grégoire Legault is a Master in Asia Pacific Policy Studies candidate at the University of British Columbia and a Fellow at the Institute of Asian Research. He has also contributed Memo #244, Memo #257, Memo #267, Memo #289 and Memo #306. You can follow him on Twitter, connect with him on Linkedin or visit his photo blog.

Not just in China anymore. The internationalization of the Bank of China and the RMB presents challenges and opportunities for Canada (credit: JHH755).

Links:

- Bank of Canada announces signing of reciprocal 3-year Canadian- dollar/renminbi bilateral swap arrangement, Bank of Canada, November 2014

- Doing More Business with China: Why Canada Needs a Renminbi Hub, Canadian Chamber of Commerce, November 2014

- RMB breaks into the top five as a world payments currency, Swift, January 2015

- Establishment of North America’s First Offshore Renminbi Centre (in Chinese), Xinhua, November 2014

- Currency Internationalisation and the Canadian Renminbi Hub: Context and Opportunities for Vancouver, Vancouver Economic Commission, October 2014

- Industrial and Commercial Bank of China Designated as the First RMB Clearing Bank in North America, Industrial and Commercial Bank of China (Canada), November 2014

- Canada-China Joint List of Outcomes 2014, Prime Minister of Canada, November 2014

Related Memos:

See our other memos on China.

Comments are closed, but trackbacks and pingbacks are open.